Depending on the state in which you reside a maintenance forecast (that is a report to assist you to determine how much money your body corporate needs to put away for future maintenance expenses) may be called a Sinking Fund Forecast (QLD), a Capital Works Forecast (NSW) or a Maintenance Plan (VIC). It may seem silly to have three different names in three different states for the same report, however this is what the individual state governments have determined.

There are a couple of tips that can help determine if your Sinking Fund is adequate, but firstly let’s explain what a Sinking Fund Forecast is and how to read a Sinking Fund Forecast graph. The graph gives an overview of your projected future expenses, levies and the fund balance from year to year.

Explanation of a Sinking Fund Forecast

A Sinking Fund Forecast is a report that predicts the replacement and repair costs to the common property of your strata titled building. A typical Sinking Fund Forecast shows a forecast over a typical 15-20 year period but most committees should consider revising one every 2 – 5 years to ensure expenses are adequately funded. The purpose of the report is to calculate how much to collect from lot owners to fund the long term maintenance of a building during the forecast period.

A Sinking Fund Forecast should include:

Predictable replacement / repair of common property items

• Painting

• Roofing

• Fencing

• Intercom

• Carpet

• Pumps

• Hot water systems

• etc…

A Sinking Fund Forecast will not include:

• Minor one-off costs

• Consumables

• General cleaning

• Landscaping

• Administration costs

• Insurance premiums

• Management costs

• Electricity costs

• etc…

What a Sinking Fund Forecast graph looks like

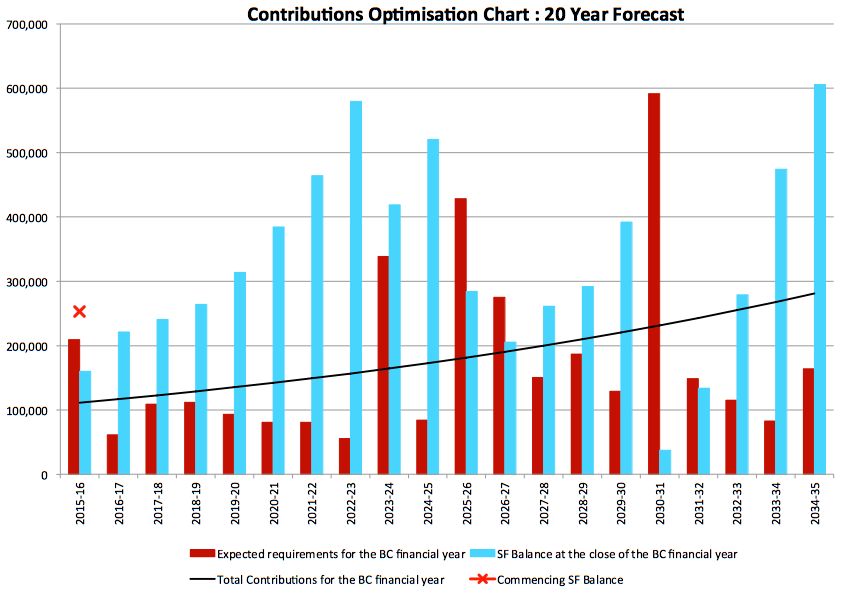

This graph will vary somewhat with each service provider but the underlying principles shown here will be the same.

There are only 4 things you need to focus on in this graph:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The blue vertical lines are the predicted Sinking Fund balances at the end of each financial year after the expected requirements for that year have been deducted.

This smooth horizontal line shows how much the body corporate will contribute over time.

Finally, the red “X” at the start of the graph is the Sinking Fund balance at the start date.

This is what a typical 20 year Sinking Fund Forecast graph looks like.

Now that you understand what a Sinking Fund Forecast is, what it covers, and you also know how to read a Sinking Fund Forecast graph, it is easier to show you how to tell if your Sinking Fund Forecast reflects reality.

Tip 1: There should always be some money in your Sinking Fund

There should always be enough money in your Sinking Fund to pay for necessary common property maintenance. If the body corporate is struggling to fund the common property maintenance then that is a sign something is wrong.

• Special Note: Keep in mind that a Sinking Fund Forecast will almost never reflect your future expenses perfectly but it should be fairly accurate. For example, if the body corporate chooses to paint the building earlier than the forecast predicts, this will mean the forecast will be inaccurate for a period of time. However as pointed out in Tip 1, there should always be enough money in your Sinking Fund to pay for necessary common property works.

Tip 2: Your Forecast should always be ‘reasonably’ accurate

If the actual Sinking Fund Balance is completely different to what is predicted then this is a sign something could be wrong. Most Sinking Funds will be different to their forecast but at any given year, if the balance in the Sinking Fund Forecast is off by more than 30% then you should speak with a quantity surveyor to help you understand how this could be happening.

So how do you check the balance?

For owners concerned that they may be under or over-funded, the only way to be sure is to engage a professionally qualified quantity surveyor, who is specialised in strata, to assess the variables mentioned above and recommend an appropriate contribution level.

With a professionally prepared Sinking Fund Forecast, which the scheme actively adopts, you can be assured that the long-term funding is appropriate. This will allow you to worry less about the adequacy of the balance at any particular point in time.

If you have any questions regarding your Sinking Fund Forecast and would like to request an obligation free quote:

our Free Call number is 1800 808 991.